The Private Health Insurance Rebate Explained

Overview:

Depending on your age and income, you could save up to one-third of your health insurance premiums with the private health insurance rebate.

This guide covers all you need to know about the private health insurance rebate, including eligibility and how to claim your discount.

Key Points

The Australian Government introduced the private health insurance rebate to encourage more people to get private health cover.

If you’re eligible for the rebate, you’ll get a rebate of up to 32% on your health insurance premiums.

To receive the rebate, you need a taxable income of less than $144,001 as a single, or $288,001 as a family.

What is the private health insurance rebate?

The private health insurance rebate is a partial refund or rebate the government provides on health insurance premiums. It’s age and income-tested, which means the percentage you can get back (i.e. your rebate entitlement) depends on your age and how much you earn.

If you’re eligible, you can get a partial refund on eligible hospital cover, extras cover, or both.

Why is there an Australian Government rebate for health insurance premiums?

The rebate was introduced to encourage more people to get private health insurance. With life expectancy and risk factors for chronic diseases like diabetes increasing^, the burden on the public healthcare system in Australia is growing.

The rebate helps lessen this burden by incentivising people to sign up with a private health insurer, saving the government money and reducing wait times for treatment in public hospitals.

Who is eligible for the private health insurance rebate?

To be eligible for the private health insurance rebate, you need to have a taxable income of less than $144,001 as a single, or $288,001 as a family*.

You also need to be an Australian citizen or permanent resident with a Medicare card, and have an eligible private health insurance policy with an Australian-registered health insurer.

How do I claim the private health insurance rebate?

There are two ways to claim the rebate:

Have it paid directly through your health fund, meaning you get an upfront reduction to your premium payments, or

Have it paid as a refundable tax offset on your tax return

If you want to claim the rebate as a reduction to your premiums, you’ll need to give your health fund your estimated income so they can calculate the premium reduction for you (you will need to fill out a Medicare Rebate claim form).

Otherwise, you can claim the rebate as a refund from the Australian Taxation Office (ATO) when you lodge your tax return.

What is the “excess private health insurance premium reduction or refund”?

When you give your health fund your estimated income, they calculate the premium reduction based on this estimate. If your actual income is more or less than expected, your rebate will be adjusted when you lodge your tax return.

If you see the phrase “excess private health insurance premium reduction or refund” on your tax return, it means you’ve received a higher rebate than you’re entitled to, and may owe some money at tax time.

The reverse is also true: if you earned less than expected and overpaid on your premiums, the government will refund you the difference on your tax return.

What are the private health rebate tiers?

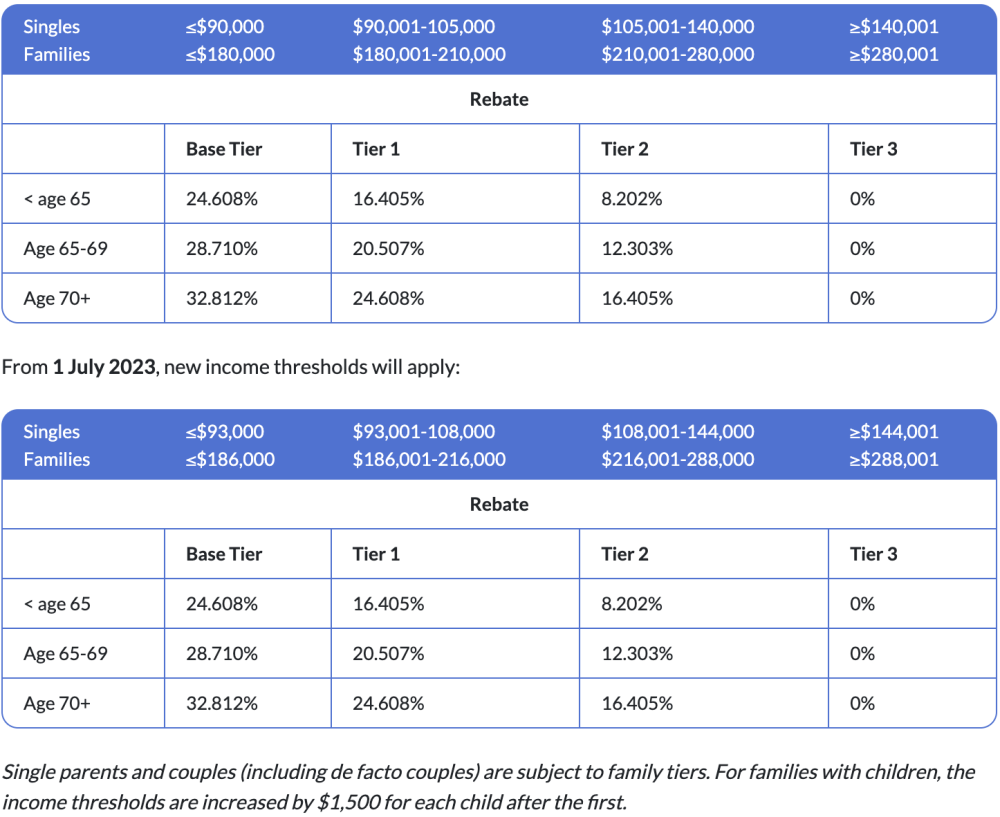

There are four private health rebate tiers each for singles and families. The tier you fall into, as well as your age, determines how much you can claim as a rebate.

Here’s a breakdown of the different tiers and rebate percentages, for the tax year just finished, and 2023/2024**:

What is the income threshold for the private health insurance rebate?

The income threshold is the maximum amount (taxable income) you can earn and receive the rebate. If you earn more than the threshold, you’re not eligible for the rebate.

The current income thresholds are $144,001 for singles and $288,001 for households.

What if I nominate an incorrect income tier?

If you tell your health fund your expected income but end up earning more or less, don’t worry. When you lodge your tax return, rebate amounts are recalculated against your actual income.

So, if you overpay on your premiums, you’ll get a refund of the difference. If you underpay, you’ll have to pay a bit extra on your tax return.

What is the Medicare Levy Surcharge (MLS)?

The Medicare Levy Surcharge is a percentage of your income payable to the ATO when you lodge your tax return. You’ll need to pay the MLS if you don’t have eligible private health cover and earn more than $93,000 as a single person or $186,000 as a family (including couples and single-parent households). These income thresholds were adjusted on 1 July 2023.

The government introduced the MLS to encourage high-income earners to get private health insurance.

MLS rates range between 1% and 1.5% of your income, depending on how much you earn.

Is it worth getting private health insurance?

In short, there are lots of good reasons to consider it.

Aside from faster non-urgent care in private hospitals compared to public hospitals and more comprehensive treatment coverage, getting private health cover can be very cost-effective, especially if you can take advantage of the private health insurance rebate.

And if you earn more than $93,000 as a single person, or $186,000 as a family, getting hospital cover as a minimum can help you avoid paying the Medicare Levy Surcharge and reduce your tax bill.

If you’re curious to know whether private health cover is right for you, it’s worth comparing multiple policies side-by-side. Click the button below to quickly and easily compare^^ cover from a panel of insurers.

COMPARE & SAVEThis guide is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.

*Income thresholds and rates for the private health insurance rebate (ATO) **Australian Government Private Health Insurance Rebate ^ Parliament of Australia, Sustainable funding of health care: Challenges ahead. ^^Compare Club compares selected products from a panel of trusted insurers. We do not compare all products in the market.

Chris Stanley is the sales & operations manager of health insurance at Compare Club. With extensive experience and expertise, Chris is a trusted leader known for his deep understanding of health insurance markets, policies, and coverage options. As the sales & operations manager of health insurance, Chris leads a team of dedicated professionals committed to helping individuals and families make informed decisions about their health insurance needs.

Meet our health insurance expert, Chris Stanley

Chris's top health insurance tips

- 1

Australia’s public health system is world-class, but wait times for public hospitals can be long, inconvenient - and leave you living in constant pain while you wait.

- 2

An appropriate private health insurance policy can speed up your surgery, relieving your pain sooner.

- 3

Family health cover means your children are covered under the same policy as you.

- 4

Many health insurance policies come with a 12-month waiting period for pregnancy-related cover, so it’s a good idea to get a family policy organized well before starting your family. This means your child will be covered from birth until at least their early twenties (depending on which health fund you select).